Introduction

Learn what is a lien on a car, how it affects car ownership, and the steps involved in clearing it when buying or selling a vehicle. When buying or selling a car, it’s essential to grasp important legal and financial terms to prevent any potential issues. A term that frequently comes up in car transactions is a lien. So, what is a lien on a car, and why should it concern both buyers and sellers? In this article, we’ll break down what a car lien is, how it functions, and what it means for vehicle ownership.

Table of Contents

Understanding What a Lien on a Car Means

A lien on a car is a legal claim placed on the vehicle by a lender or a financial institution until the loan used to purchase the car is fully repaid. In essence, the car acts as collateral, meaning that if the loan is not repaid, the lender has the right to take possession of the vehicle.

How Does a Lien Work on a Car?

When a car is financed through a loan, the lending institution holds a lien on the car. This ensures that if the borrower defaults on the loan payments, the lender can recover the outstanding amount by repossessing and selling the car. The lien remains active until the loan is fully paid off, at which point the lien is removed, and the borrower holds full ownership of the car.

Types of Car Liens

There are two primary types of liens associated with vehicles:

- Voluntary Lien: This type of lien is agreed upon when a car is financed through a loan. The buyer is aware that the lender will hold the lien until the loan is repaid.

- Involuntary Lien: This type of lien can be placed by a third party, such as a government or a mechanic, due to unpaid debts related to the vehicle, such as unpaid taxes or repair costs.

Why Are Liens Placed on Cars?

Liens provide a level of security for lenders. It ensures that the borrower has a financial obligation to repay the loan, and the vehicle acts as collateral. Here’s why a lien might be placed on a car:

- Car Loans: When a car is purchased using a loan, the lien is part of the agreement between the lender and the borrower.

- Unpaid Repairs or Services: If a mechanic performs significant repairs on a car and the owner fails to pay, a lien can be placed on the car until the debt is cleared.

- Unpaid Taxes: Some government bodies may impose a lien on a vehicle for unpaid property taxes or other financial obligations.

How Can You Verify if a Car Has an Active Lien?

If you’re buying a used car, verifying whether a lien exists on the vehicle is essential. Below are several methods to verify:

- Vehicle History Report: Services like Carfax or AutoCheck provide detailed vehicle history reports, including information about any existing liens.

- Contact the DMV: You can request a lien search through your state’s Department of Motor Vehicles (DMV). They can verify the car’s title status and any outstanding liens.

- Ask the Seller: If you’re purchasing a car from a private party, ask them directly if the vehicle has any outstanding liens. You can request documentation to verify this.

The Risks of Buying a Car with a Lien

Purchasing a car with an outstanding lien can lead to significant complications. Here are the potential risks:

- Ownership Transfer Issues: You won’t be able to transfer the title of the car into your name until the lien is cleared.

- Financial Liability: If you purchase a car without realizing there’s a lien, you could be held responsible for the remaining loan balance or debts tied to the lien.

- Repossession Risk: The lender holding the lien may repossess the car if the lien isn’t resolved, even after you’ve purchased it.

How to Remove a Lien from a Car

If you’re dealing with a lien on a vehicle, understanding what is a lien on a car is the first step to resolving it. Removing a lien ensures that the title is clear, which is essential whether you’re selling or keeping the car. Typically, removing a lien involves paying off any remaining debts linked to the vehicle, such as an auto loan. Let’s go over the steps needed to remove a lien from a car.

Step 1: Pay Off the Loan or Debt

When learning what is a lien on a car, it’s important to understand that it usually exists because the car was financed. To remove the lien, the borrower must pay off the remaining loan balance. Once the debt is cleared, the lender will release the lien, and ownership can fully transfer it to the car owner.

- Contact the Lender: If you’re unsure what is a lien on a car, contacting your lender for details about the remaining loan balance is the best place to start.

- Make the Payment: After you know the exact amount, pay off the remaining balance. This will clear the lien tied to the car.

- Obtain a Lien Release: Once the loan is paid, the lender will issue a lien release, which serves as official documentation showing that “what is a lien on a car” has been resolved.

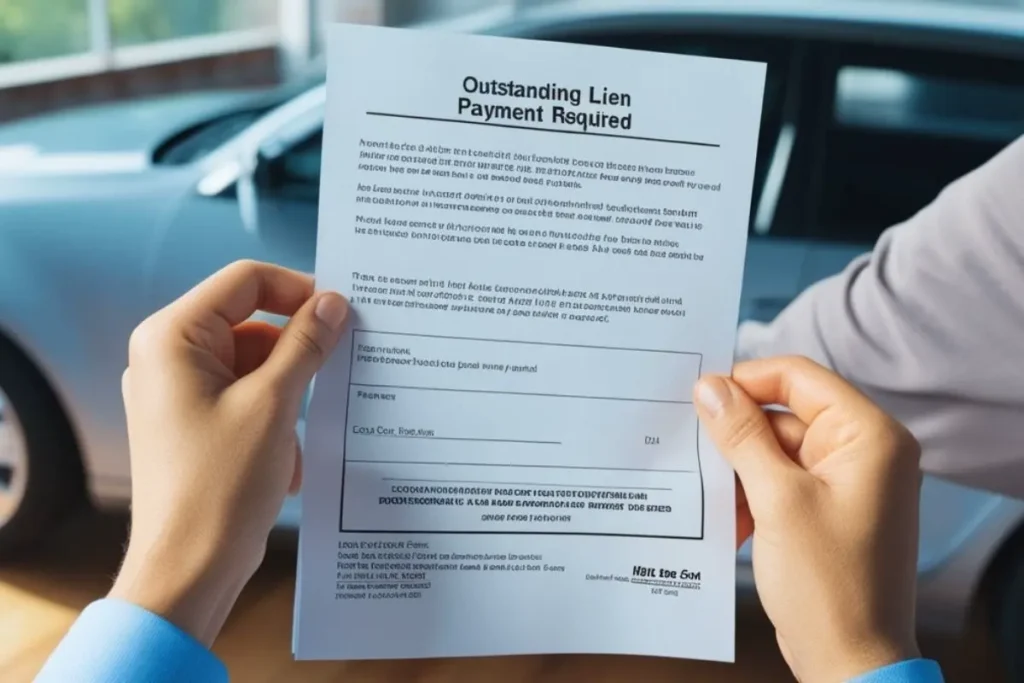

Step 2: Obtain a Lien Release Document

A lien release is a critical document that verifies that the lien has been lifted. This step is important when understanding what is a lien on a car, as this document officially removes the lender’s legal claim on the vehicle.

- Keep the Lien Release Safe: The lien release is key to confirming that the lien on the car has been cleared. You’ll need it when transferring the title.

- Verify All Details: Double-check that the lien release document includes all the necessary information related to “what is a lien on a car”, including the vehicle’s VIN, lender’s name, and your information.

Step 3: Update the Title at the DMV

After receiving the lien release, the next step is to remove the lien from the car’s title at the DMV. This finalizes the process of clearing what is a lien on a car and ensures the title is free of any financial obligations.

- Submit the Lien Release to the DMV: To fully resolve what is a lien on a car, bring the lien release letter and your current vehicle title to your local DMV.

- Pay Title Transfer Fees: Removing what is a lien on a car may involve paying a small fee to update the title, depending on the regulations in your state or region.

- Receive a New Title: Once the lien is removed, you’ll be issued a new title showing that the car is fully yours, free of any lien.

Is It Possible to Sell a Vehicle That Has a Lien?

If you’re trying to sell a car with an active lien, it’s essential to understand the process and what is a lien on a car. You can sell the car, but the lien must be paid off to transfer ownership properly. Let’s look at how to handle this situation effectively.

Inform the Buyer About the Lien

Transparency is key when selling a car with a lien. Make sure the buyer understands what is a lien on a car and how it affects the sale process. This helps prevent complications later.

- Be Open About the Lien: Inform the buyer early in the process that there is a lien on the car. Explain clearly what is a lien on a car, so they understand what needs to happen for the sale to proceed.

- Provide Documentation: Show the buyer proof of the lien and give them a clear understanding of the remaining balance. This transparency regarding what is a lien on a car builds trust and ensures a smoother transaction.

Coordinate the Payoff Process with the Buyer

When selling a car with a lien, part of the sale proceeds must go toward paying off the loan. This is a crucial step in dealing with what is a lien on a car and ensuring the title is clear for the new owner.

- Negotiate the Payoff: Discuss with the buyer how the loan payoff will be handled. Make sure they understand that a portion of the payment will clear what is a lien on a car before the title transfer can occur.

- Direct Payment to Lender: In some cases, the buyer may make the payment directly to the lender to resolve what is a lien on a car. This guarantees that the lien is cleared before they take ownership.

Escrow Services for Safe Transactions

To protect both buyer and seller during the transaction, using an escrow service can ensure a secure and smooth sale, especially when dealing with what is a lien on a car.

- Ensures Security for Both Parties: Escrow services hold the buyer’s funds until what is a lien on a car has been resolved, ensuring that both parties are protected.

- Prevents Disputes: Funds are only released when the lien has been officially cleared, helping to avoid any disputes or misunderstandings over the lien status.

What Happens If You Don’t Remove the Lien?

Failing to remove a lien before selling a car can lead to significant issues. Understanding what is a lien on a car is essential to avoid legal and financial problems. Here’s what could happen if the lien remains unresolved.

Difficulty Transferring Ownership

Without clearing the lien, the title transfer process cannot be completed. This is one of the key points of understanding what is a lien on a car—you can’t transfer ownership until the lien is removed.

- Title Transfer Issues: The DMV won’t allow the transfer of ownership while there’s an active lien on the car.

- Legal Problems: Selling a car with an unresolved lien without informing the buyer could lead to legal complications.

Repossession Risk

If what is a lien on a car remains unresolved, the lender has the right to repossess the vehicle. Even if the car has been sold, the new owner may lose the car if the lien is still active.

- Lender’s Right to Repossess: The lender can legally repossess the car if what is a lien on a car isn’t cleared, even after the sale.

- Financial Liability: The new buyer may seek compensation from you if they lose the car due to a lien that wasn’t resolved.

How to Avoid Liens on Future Car Purchases

Now that you understand what is a lien on a car, it’s important to know how to avoid buying a car with an active lien in the future. Here are a few precautions to take when purchasing a vehicle.

Always Check Vehicle History Reports

Before finalizing a car purchase, it’s crucial to run a vehicle history report. These reports help you check if there’s an active lien and give you a clearer picture of the car’s past, making it easier to understand what is a lien on a car and avoid buying one with unresolved financial obligations.

- Get a Vehicle History Report: Services like Carfax or AutoCheck provide detailed vehicle history reports, which will help you verify what is a lien on a car and ensure that the title is clear.

- Avoid Future Issues: By confirming there are no liens, you prevent any complications down the road that stem from unresolved financial claims on the car.

Buy from Reputable Sellers

One of the easiest ways to avoid worrying about what is a lien on a car is to purchase your vehicle from a reputable dealership. Dealerships typically take care of all the paperwork, ensuring the car’s title is free from liens.

- Dealers Handle the Details: When buying from a reputable dealership, they take care of clearing what is a lien on a car before selling the vehicle.

- Extra Caution with Private Sales: If you’re buying from a private seller, it’s up to you to investigate and verify what is a lien on a car and make sure the title is clean.

What Potential Risks Come with Purchasing a Car That Has a Lien?

Purchasing a car with an active lien can lead to various complications. Before making any decisions, it’s important to fully understand what is a lien on a car and how it may impact your ownership of the vehicle. Below are some of the possible risks you might face:

Difficulty Transferring the Title

When you buy a car with an active lien, the title cannot be transferred into your name until the lien is resolved. This delay can prevent you from fully owning the vehicle, which means you won’t have the legal right to sell or make changes to the car. For example, if you’re purchasing a Toyota or Ford vehicle, make sure to verify that the title is free of liens.

- Unclear Ownership: Until the lien is paid off, the lender has a claim on the vehicle. Even if the seller hands over the car, you won’t have legal ownership until the lien is cleared.

- Problems with Registration: Most DMVs will not allow you to register the car in your name while there’s an active lien. This could result in delays in legally driving the vehicle.

Responsibility for Unpaid Debt

If you buy a car without knowing there’s a lien on it, you may be held responsible for the remaining debt. The lender may pursue you for payment or repossess the car, which could leave you in a financially difficult situation.

- Financial Liability: Even though you are not the original borrower, the lien remains attached to the car. If the debt isn’t settled, you could lose the car to repossession or have to cover the outstanding balance.

- Unexpected Costs: In some cases, buyers end up paying off the debt to avoid repossession. This adds unexpected costs on top of what you’ve already paid for the car.

Risk of Repossession

Even after purchasing the vehicle, if the original loan tied to the lien remains unpaid, the lender has the legal right to repossess the car. This can happen even if the seller is no longer involved, leaving you without both the car and your money.

- Lender’s Right to Repossess: If the seller does not clear the lien, the lender can take the vehicle back, regardless of your ownership.

- Loss of Funds: In most cases, the buyer won’t be compensated if the car is repossessed due to an unresolved lien.

How to Protect Yourself When Buying a Car

Now that you understand what is a lien on a car, it’s essential to take steps to protect yourself as a buyer. Here are some key strategies to ensure you don’t purchase a car with an unresolved lien.

Check the Title Before Finalizing the Purchase

The first step to protecting yourself is to check the title of the vehicle. You should verify that the title is clear of any liens before moving forward with the purchase.

- Request a Title Check: Always ask the seller to provide a copy of the vehicle’s title and confirm whether there are any liens attached.

- Verify with the DMV: Double-check with your local DMV or equivalent authority to ensure the title is clear and that what is a lien on a car doesn’t apply to the vehicle you’re buying.

Use a Vehicle History Report

A vehicle history report is a useful tool for understanding the background of the car, including its lien status. This report can provide peace of mind, confirming that the car is free of any financial obligations. Brands such as Honda or BMW provide official resources for vehicle history and lien verification.

- Request a Full History Report: Services like Carfax or AutoCheck provide comprehensive reports that detail the lien history, ownership, accidents, and more.

- Spot Potential Red Flags: If the report indicates an active lien, proceed with caution and ensure the lien is resolved before purchasing.

Consider Using an Escrow Service

To avoid any risks, consider using an escrow service during the transaction. This way, the buyer’s funds are held securely until the lien is cleared and the title is ready to be transferred.

- Secure Payment: The buyer’s money is held by the escrow service until the lien has been fully resolved, preventing any financial risk.

- Lien Release Verification: The escrow service can help ensure that “what is a lien on a car” has been resolved before the funds are released to the seller.

How to Clear a Lien When Selling a Car

When selling a car with a lien, it’s essential to understand how to handle the lien removal process to avoid complications. Here’s a step-by-step guide to ensure a smooth sale.

Communicate with the Lender

If you’re selling a car with an outstanding loan, contact your lender to inform them of the sale. They will provide the payoff amount needed to release the lien.

- Request the Payoff Amount: The lender will give you the exact amount required to pay off the loan and release the lien.

- Coordinate the Payoff with the Buyer: Once you’ve agreed with the buyer, the sale proceeds can be used to clear the lien, ensuring a clean transfer of ownership.

Provide the Lien Release Document to the Buyer

Once the lien has been cleared, you’ll receive a lien release document from your lender. This document is crucial for the buyer to complete the title transfer process. Even luxury brands like Mercedes-Benz have protocols for lien clearance when selling a vehicle.

- Secure the Lien Release: Ensure the lender provides a lien release document promptly after the loan is paid off.

- Hand Over All Necessary Documents: Provide the lien release and the vehicle’s title to the buyer to ensure the transfer process goes smoothly.

Finalize the Title Transfer at the DMV

The final step in selling a car with a lien is transferring the title. The buyer will need the lien release and the title to complete the transfer at the DMV.

- Assist with the DMV Process: Depending on your location, you may need to accompany the buyer to the DMV to complete the title transfer.

- Clear Ownership: Once the lien is removed, and the title is transferred, the buyer becomes the full legal owner of the vehicle.

Conclusion: Understanding What Is a Lien on a Car

In conclusion, understanding what is a lien on a car is crucial whether you’re buying or selling a vehicle. A lien gives the lender a legal claim on the vehicle until the loan or debt is fully paid. While buying a car with a lien can present challenges, with the right precautions—such as verifying the title and using a vehicle history report—you can avoid potential risks. On the other hand, if you’re selling a car with a lien, ensuring the lien is cleared before transferring ownership is essential for a smooth and successful transaction.

By being aware of what is a lien on a car, you can navigate the buying or selling process more confidently, ensuring that both parties are protected and that the vehicle’s title is free of financial obligations.

If you’re looking for advice on how to keep your vehicle in top shape, explore our comprehensive guide on Car Maintenance & Troubleshooting.